Rumored Buzz on Custom Private Equity Asset Managers

Wiki Article

The Facts About Custom Private Equity Asset Managers Uncovered

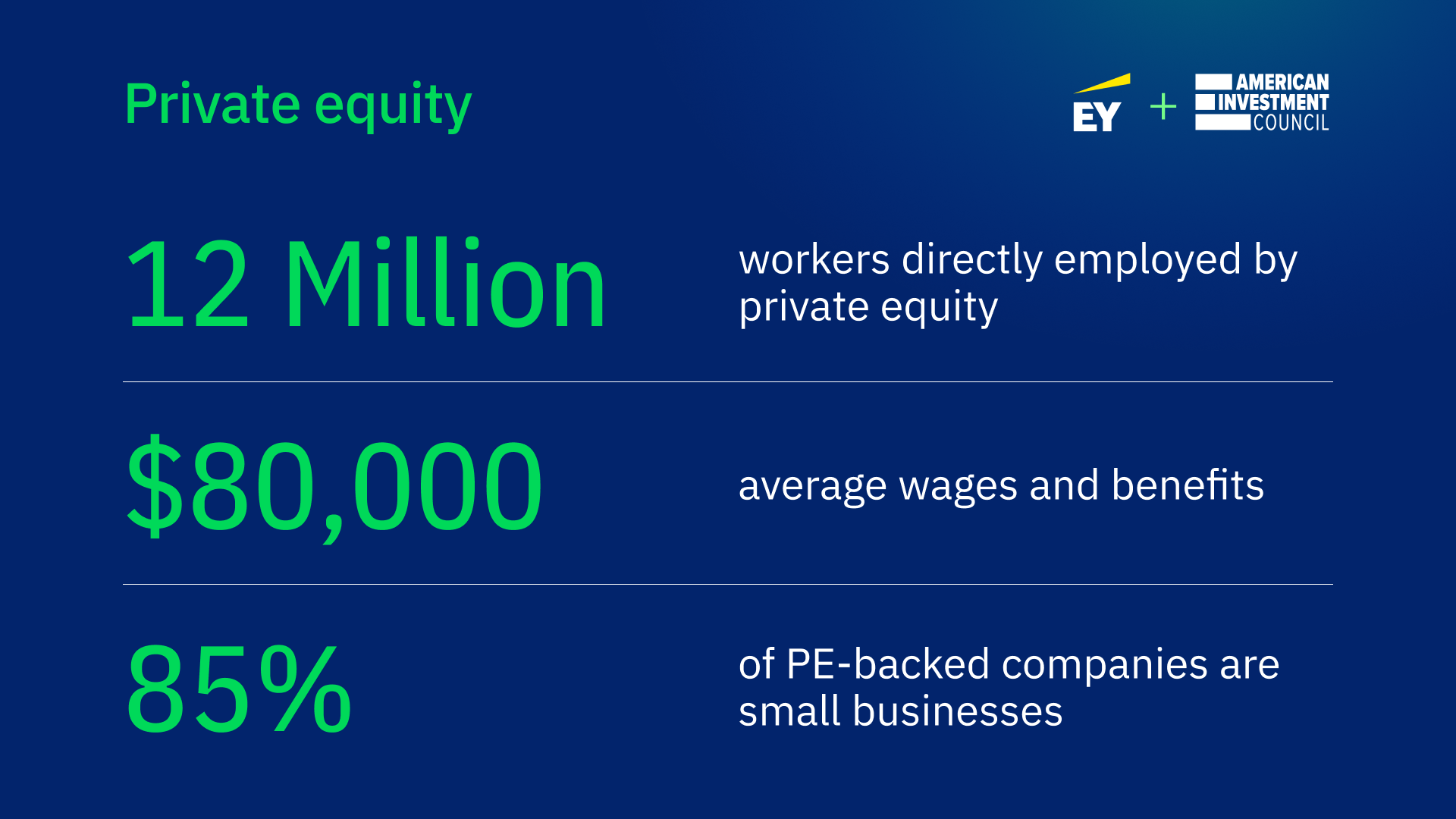

You have actually probably come across the term exclusive equity (PE): investing in firms that are not publicly traded. About $11. 7 trillion in assets were handled by exclusive markets in 2022. PE firms look for opportunities to gain returns that are better than what can be accomplished in public equity markets. Yet there may be a couple of things you do not comprehend about the market.

Partners at PE firms elevate funds and take care of the money to generate positive returns for investors, normally with an financial investment perspective of in between 4 and 7 years. Private equity firms have a variety of financial investment choices. Some are rigorous sponsors or easy capitalists completely reliant on administration to expand the company and generate returns.

Since the very best gravitate towards the bigger bargains, the center market is a substantially underserved market. There are much more sellers than there are extremely skilled and well-positioned finance professionals with substantial purchaser networks and resources to manage a deal. The returns of exclusive equity are usually seen after a couple of years.

7 Easy Facts About Custom Private Equity Asset Managers Explained

Traveling below the radar of large international firms, a number of these little business often provide higher-quality customer support and/or niche items and solutions that are not being used by the large conglomerates (https://custom-private-equity-asset-managers.mailchimpsites.com/). Such benefits draw in the rate of interest of personal equity firms, as they have the insights and savvy to exploit such opportunities and take the business to the following level

Private equity capitalists need to have reliable, capable, and reputable management in place. Most supervisors at profile firms are offered equity and benefit compensation structures that compensate them for hitting their monetary targets. Such positioning of goals is commonly needed before a bargain gets done. Personal equity opportunities are often unreachable for individuals that can't spend countless dollars, yet they shouldn't be.

There are regulations, such as restrictions on the aggregate quantity of cash and on the variety of non-accredited financiers. The private equity company draws in some of the very best and brightest in business America, including leading entertainers from Lot of money 500 business and elite monitoring consulting companies. Law practice can also be recruiting grounds for personal equity employs, as bookkeeping and legal skills are required to total deals, and deals are extremely looked for after. he said https://www.merchantcircle.com/blogs/custom-private-equity-asset-managers-abilene-tx/2023/12/The-Power-of-a-Private-Equity-Firm-in-Texas-and-Asset-Management-Group/2608142.

More About Custom Private Equity Asset Managers

One more downside is the lack of liquidity; once in an exclusive equity deal, it is hard to leave or offer. There is an absence of adaptability. Exclusive equity additionally includes high fees. With funds under administration already in the trillions, exclusive equity firms have become eye-catching investment cars for wealthy people and organizations.

Now that access to private equity is opening up to even more specific capitalists, the untapped potential is becoming a reality. We'll begin with the major disagreements for spending in personal equity: Exactly how and why private equity returns have historically been higher than various other assets on a number of levels, How including personal equity in a portfolio affects the risk-return account, by assisting to branch out against market and intermittent threat, After that, we will describe some key factors to consider and risks for exclusive equity capitalists.

When it comes to presenting a new asset right into a portfolio, the many fundamental consideration is the risk-return account of that possession. Historically, private equity has exhibited returns similar to that of Arising Market Equities and greater than all various other typical property classes. Its fairly low volatility coupled with its high returns creates an engaging risk-return profile.

9 Easy Facts About Custom Private Equity Asset Managers Described

Private equity fund quartiles have the largest array of returns across all different asset classes - as you can see listed below. Methodology: Inner rate of return (IRR) spreads out calculated for funds within classic years separately and after that balanced out. Average IRR was calculated bytaking the average of the median IRR for funds within each vintage year.

The result of adding exclusive equity into a profile is - as always - reliant on the portfolio itself. A Pantheon study from 2015 recommended that including exclusive equity in a portfolio of pure public equity can unlock 3.

On the various other hand, the very best exclusive equity companies have access to an even bigger swimming pool of unidentified opportunities that do not encounter the exact same scrutiny, as well as the resources to perform due persistance on them and identify which are worth purchasing (Syndicated Private Equity Opportunities). Investing at the very beginning suggests greater threat, but also for the firms that do succeed, the fund gain from higher returns

Get This Report about Custom Private Equity Asset Managers

Both public and exclusive equity fund managers dedicate to investing a percentage of the fund however there continues to be a well-trodden issue with aligning rate of interests for public equity fund monitoring: the 'principal-agent problem'. When an investor (the 'primary') works with a public fund supervisor to take control of their resources (as an 'representative') they hand over control to the supervisor while retaining ownership of the assets.

In the case of exclusive equity, the General Partner does not simply earn a management fee. Exclusive equity funds likewise mitigate an additional form of principal-agent trouble.

A public equity investor ultimately wants one point - for the monitoring to increase the supply cost and/or pay out rewards. The capitalist has little to no control over the choice. We showed over how numerous exclusive equity strategies - specifically bulk buyouts - take control of the operating of the business, ensuring that the long-lasting worth of the business precedes, raising the return on investment over the life of the fund.

Report this wiki page